Your legacy will help the world's most vulnerable children

If you’re considering a gift in your Will to SOS Children’s Villages Canada, you’re including some of the world’s most desperate children in your embrace. Your bequest – be it magnificent or modest – is a gesture of pure love extended to a child you will probably never meet. Perhaps that child is yet to be born.

Dave Greiner, Sr. VP Operations

D.Greiner@soschildrensvillages.ca

Call Dave Direct at:

Call Dave Toll Free at:

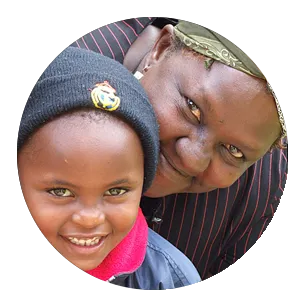

Maria knows there is no greater gift than the gift of family

"I think for any child it is very important to have that one person who really, really cares"

Maria Virjee, SOS Legacy Donor

SOS Children’s Villages is the world’s largest charity dedicated to providing safe, warm, loving homes to orphaned and abandoned children in the world’s poorest countries.

Without an SOS home and mother, these children would spend their days living in hunger and danger of exploitation and cruelty.

Your gift not only rescues these children, it builds their future by providing a safe home, healthy food, school, medical care – and most importantly, the love of an SOS mother who will raise them until adulthood.

And, as you well know, there’s nothing in life that compares to a mother’s love.

Create your Will Today!

A gift in your Will to SOS Children’s Villages Canada can transform countless young lives beyond your own lifetime. And doing so has never been easier.

We’ve partnered with Epilogue Wills to offer a fast and affordable way for our donors to make their Wills online. Please click below to start your Will and save 20%.

It is always recommended that you obtain legal advice from a licenced lawyer in your province to ensure that your testamentary wishes are properly expressed and will be respected.

You may be surprised to realize how incredible a gift in your Will can be. People are sometimes thrilled to learn that an apparently modest bequest (like 10% of their estate) can actually amount to more money than they gave in their entire lifetime. Bequests are indeed an opportunity for ordinary supporters to make truly extraordinary philanthropic gifts.

If you do decide to make a gift in your Will, you are not alone. There are more than 2 million Canadians alive today who have planned bequests to charities. Their spirit of giving will live on – and indeed transform countless lives – for generations to come. The word ‘philanthropy’ means ‘love of humankind’. Surely, those of us who plan these bequests are making the noblest of philanthropic gifts.

If you would like to discuss a legacy gift with us, we would love to hear from you. Please feel free to call Dave Greiner at 1-800-767-5111 anytime.

Legal name and address:

SOS Children’s Villages Canada

240-44 Byward Market Square

Ottawa, ON K1N 7A2

Canadian Charity Number:

13824 7259 RR0001

Frequently Asked Questions for Wills and Legacy Giving

-

This varies from person to person. Some people who are leaving bequests to many family members make a gift of a small share of their estate to their favourite charity or charities. Others, who have little or no family, sometimes leave much more. This is an entirely personal choice.

-

A gift in your Will is ‘revocable’. This means that you can amend it at any time. Your Will stays in your control for as long as you live. You may increase, decrease or cancel your charitable gift at any time.

-

There are many answers to this question. First, many supporters come to realize that they have enough in their estate to provide bequests to family members and to allocate a share to the causes and charities that are most important to them. Making a gift in your Will is a highly personal choice – and it’s not for everyone. Our purpose here is to offer you giving options to consider.

-

People include gifts in their Will to make the world a better place in some way. Having said that, there are tax benefits when you leave a charitable bequest. When you pass away, your Trustee or Executor must file your final tax return. Gifts to charity in your Will can generate significant tax credits, sometimes eliminating all taxes owing on your final return. Bequests to family members, however, do not generate tax savings.

-

There are two popular methods which are very simple indeed. The first is to leave a specific dollar amount or a percentage of your estate. The second is to leave what is known as ‘a residual bequest’ of your estate. The residual bequest is a bequest for what’s left in your estate after your debts, taxes, expenses and specific bequests have been distributed.

-

Again, this is a personal choice. As a rule, we encourage you to consult with your legal or financial advisor to ensure that your wishes are effectively carried out.